Buying your first home in Vail, Colorado is exciting — but becoming a homeowner in one of the favorite ski destinations in the world can be a little intimidating, too.

Fortunately, first-time home buyers in the Vail Valley have access to plenty of support throughout the home-buying process. That ranges from homebuyer education programs and advice to financing in the form of Vail mortgage loans.

Vail, CO Home Buyer Overview

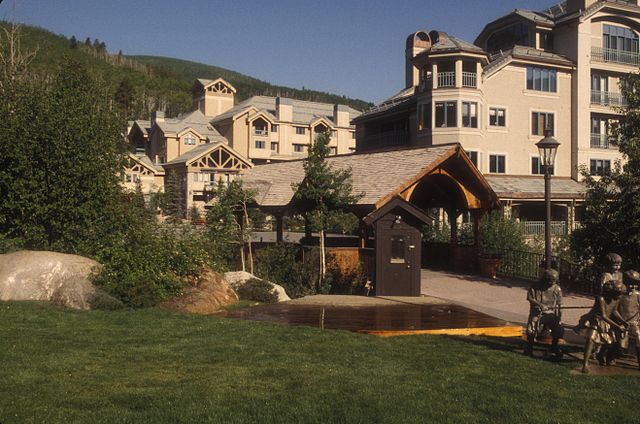

Vail is popular for its upscale amenities and massive ski resort, the largest in the state. The town, which boasts a population of about 5,000 people, is located on both sides of I-70, about 2 hours west of Denver in Eagle County.

According to the Zillow Home Values Index, home prices in the town are way above the national average. The typical home value of homes in Vail, CO is $1.75M.

Home values have gone up 26.4 percent over the past year.

So, it’s just as well there are mortgage loans for first-time home buyers in Vail.

First-Time Home Buyer Loan Programs in Vail, CO

If you’re a first-time buyer in Vail with a 20 percent down payment, you can secure a conventional Vail mortgage loan — likely with a low-interest rate and no PMI (Private Mortgage Insurance).

Putting 20 percent down will keep your monthly mortgage payments low and might also give you an edge in competitive housing neighborhoods like Beaver Creek Village, Arrowhead at Vail, Shadow Mountain, and Downtown Aspen.

However, only a small proportion of first-time borrowers have saved that much.

The good news is that there are wide-ranging mortgage loan options that can help homebuyers in Vail get into a new house with low or even no down payment:

- FHA loan: Backed by the Federal Housing Administration.

- Conventional 97: A home loan backed by Freddie Mac or Fannie Mae.

- USDA loan: Meant for families on low-to-moderate income who want to make affordable homeownership a reality.

- VA loan: This loan is meant for veterans and active-duty service members.

- Colorado Housing Assistance Corporation (CHAC) and Colorado Housing and Finance Authority (CFHA) mortgage loans: These are assisted mortgage programs offered locally and statewide meant to help first-time home buyers make an affordable home purchase.

- Jumbo Mortgage Loans: These are home loans that exceed the conforming loan limit set by the Federal Housing Finance Agency (FHFA).

- Resort Lending: A specialized type of real estate lending that finances the development, construction, and operation of resort properties.

- Jeff Koch Mortgage Broker: Jeff Koch has been lending in the vail valley for over 35+ years. The Vail mortgage company has many innovative lending programs that warrant its status as the top overall lender in Vail.

NB: Government loan programs (including FHA, USDA, and VA home loans) require you to purchase a primary residence. This means you cannot use these loans for an investment property or vacation home.

Need a Mortgage?

Jeff Koch Mortgage Broker is a Vail mortgage company serving the Vail region, including Vail Village, Lionshead, and Golden Peak. We are proud to offer a wide variety of mortgage products and programs with flexible qualification criteria since the 90s.

Don’t hesitate to get in touch with us if you have questions or are ready to apply for a loan.